RENT2BUY CAR FINANCE

Struggling to find a job?

We can help. Rent-to-buy opportunities for everyone, regardless of background.

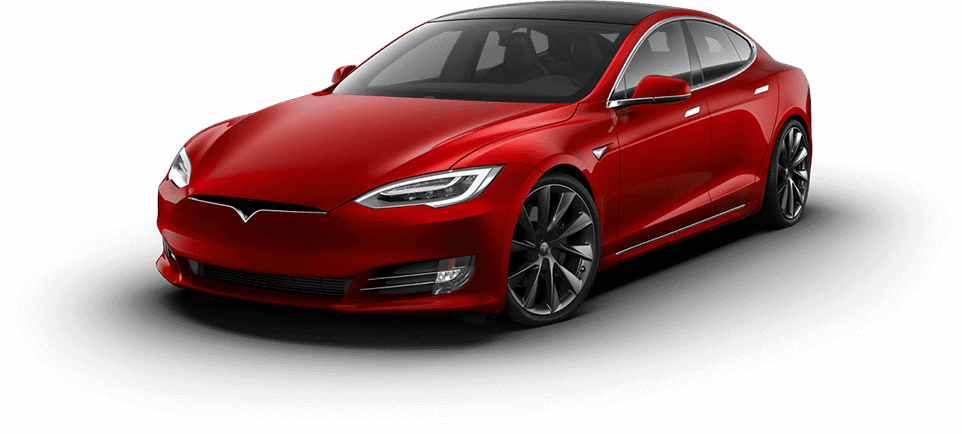

Featured Listings

What is HP Car Finance?

Considering HP Car Finance? Watch this short video to find out how hire purchase agreements work, the pros and cons, and whether it could be the right solution for you.

Dealer Network

Simply fill the form and a member of our team will contact you shortly

Frequently Ask Question

With a hire purchase (HP) agreement, you can pay off your loan early if you pay the settlement figure. This is the amount of money it will cost to pay off your loan in full and is usually made up of the remaining loan amount plus interest. Your finance company will be able to let you know how much this will be. The further you are into your agreement, the lower your settlement figure may be. Don’t forget to check the terms of your loan to find out whether you’ll need to pay a fee for settling your finance early.

To sell a car on hire purchase, you’ll need to either wait until the end of your loan term and you own the car or request the settlement figure to end the agreement early. This is because HP car finance is secured against the vehicle and the finance company owns it until you’ve made all the repayments. This means that you can’t sell the car or make any major modifications during your agreement.

The Option to Purchase fee is an amount of money that you may need to pay at the end of your hire purchase agreement to cover admin costs and officially become the car’s owner. This is typically a much lower amount than a balloon payment would be with a PCP agreement.

The cost of your HP agreement will depend on how much you want to borrow, how long you need to pay it back, and your credit score. Typically, HP monthly repayments are cheaper than they would be with a personal loan as the finance is secured against the vehicle. However, you won’t own the car until you’ve finished making all your payments.

Putting down a deposit when buying a car can reduce the amount you need to borrow and increase your chances of securing a loan. In a typical hire purchase agreement, you can put down a deposit of 10% or more of the car’s value. However, if you don’t have any money saved or a vehicle to part-exchange than you may be able to find a no deposit hire purchase deal.

The best way to finance a car depends on your individual circumstances, the car you’d like to buy, and how you plan to use it. If car ownership is important to you then buying outright, choosing a personal loan, or opting for a hire purchase agreement might be the best choice for you. However, if you like to change car regularly and prioritise lower monthly repayments over owning a car then personal contract purchase (PCP) could give you more options at the end of your agreement.

When you buy a car on finance it might affect your credit rating temporarily as you’ll be taking on a relatively large new debt. However, successfully managing your car finance and making all your payments on time could improve your score over time as it proves you’re a reliable borrower.

Lenders will also make a hard search on your credit report as part of the loan application process. Too many hard searches in a short time can negatively impact your credit score. However, this doesn’t have to stop you getting the best deal for your car finance. When you apply with 247 Car Rental , we’ll run a soft search to find out if we can find you an approval in principle from one of the lenders on our panel. It’s only if you choose to proceed with the loan offered that a hard search, which may affect your credit score, would take place.

When applying for hire purchase finance with 247 Car Rental , you will be asked to provide the following details and documents:

- Personal details including your full name, marital status, date of birth, and address history

- Employment details and history

- Estimated amount you’d like to borrow

- Email address and phone number

- Driving licence

- Proof of address

- Proof of income

If you can’t afford your HP repayments and you have already repaid 50% of the total amount payable, then you have the right to voluntarily terminate your agreement and hand the car back. The total amount payable doesn’t just mean the amount you’ve borrowed, it also includes any fees or interest. If you want to keep your car, you may be able to reduce your monthly payment amount by applying for a refinance loan. When you refinance, you take out a new finance agreement, usually with a new lender, to pay the balance on an existing hire purchase loan. You might be able to swap to a loan with cheaper monthly repayments and a longer repayment period instead.